[ad_1]

Barbecue meals stands and meals vehicles are a standard sight at outside occasions, festivals, and festivals, and supply scrumptious meals for purchasers on the go. As an insurance coverage agent or dealer, it’s important to know the dangers related to a lot of these companies and supply applicable insurance coverage protection to guard them towards potential losses. On this weblog, we’ll focus on what to contemplate when writing insurance coverage for barbecue meals stands and meals vehicles.

Barbecue meals stands and meals vehicles are categorized beneath the NAICS code for mobile food services. These companies usually serve a restricted menu consisting of sandwiches, salads, snacks, sizzling canine, pretzels, specialty meals gadgets, and gentle drinks. Some gadgets are pre-packaged, whereas others are ready to buyer specs. Condiments could also be accessible, and restricted seating could also be offered for on-premises consumption. Nevertheless, prospects often buy gadgets and eat them elsewhere.

What’s the distinction between a “Meals Truck” and a “Cell Meals Stand”

A meals truck is a motorcar, that has an engine and is licensed to be used on public roads and thoroughfares. When not in use, it may be pushed to a different location and arrange there.

A “Cell Meals Stand” could be one among a number of various things, nevertheless, it isn’t a automobile. Kiosks, small moveable buildings, catering trailers or carts, even BBQ pits mounted on trailers… all of those are cellular meals stands, able to being moved from one place to the opposite however not beneath their very own energy.

Barbecue meals stands and meals vehicles might function on a seasonal foundation, and they are often free-standing or situated inside a bigger operation equivalent to an enviornment, division retailer, truthful, workplace constructing, park, or stadium.

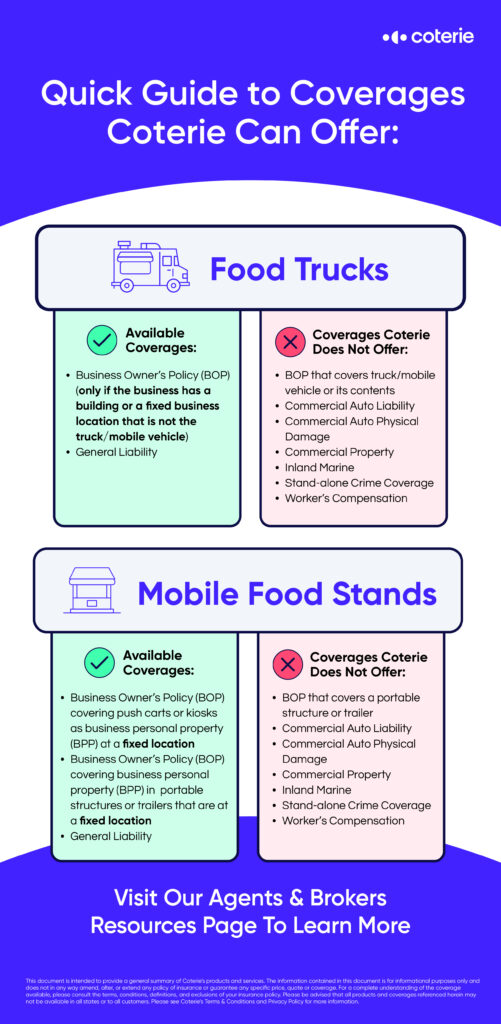

To guard barbecue meals stands and meals vehicles towards potential losses, insurance coverage brokers and brokers ought to take into account the next kinds of protection for Meals Vehicles and Meals Stands:

- General Liability Insurance: Common legal responsibility insurance coverage supplies protection for bodily harm, property injury, and private and promoting harm attributable to the enterprise’ operations. Since barbecue meals stands and meals vehicles serve meals, there’s a excessive danger of meals poisoning, contamination, and allergic reactions. Prospects may slip and fall, resulting in bodily harm. Common legal responsibility insurance coverage may help shield the enterprise towards such dangers. Common legal responsibility protection would shield the insured for accidents or injury attributable to his meals service (enterprise) operations; nevertheless, this doesn’t embrace the operation of the truck as a motorcar. Many municipalities require meals truck operators to offer proof of GL protection with a purpose to receive a allow or function the truck in sure areas. Once more, normal legal responsibility protection does NOT cowl the operation of the insured’s meals truck or different industrial or private automobiles.

- Property Insurance coverage: Property insurance coverage supplies protection for injury to the enterprise property as a result of coated perils equivalent to hearth, theft, and vandalism. Since barbecue meals stands and meals vehicles usually use electrical wiring, refrigeration models, cooking gear, and heating and air-con programs, they’re uncovered to property dangers. Wiring should be as much as code, well-maintained, and enough to help refrigeration models. Ammonia utilized in refrigeration models can explode. A system designed to detect leaks needs to be in place. Refrigeration gear should be inspected and maintained on an ongoing foundation. Whereas cooking could also be restricted to microwave and toaster ovens, there could also be grills or deep fats fryers which should be protected by automated hearth extinguishing safety, hoods, and filters over all cooking surfaces.

It is very important word that the property protection Coterie supplies beneath a enterprise house owners’ coverage DOES NOT cowl the precise meals truck. If a meals stand will not be a automobile however continues to be cellular, we don’t present property protection to the construction itself both.

In relation to Enterprise Private Property (BPP), Coterie can cowl the contents within the truck, except it’s completely situated. In any other case, the off-premises limits will cowl these contents. Make sure you affirm that the off-premises limits beneath a BOP are adequate on your shopper. (Be aware: any gear completely mounted in or on the truck needs to be included within the truck’s worth and coated beneath the auto bodily injury coverage.)

*The next coverages can be found with Coterie Insurance coverage provided that the enterprise has a constructing or a set enterprise location that isn’t the automobile or cellular construction:

- Crime Protection – This protection is included in Coterie’s base Business Owners Policy (BOP)

- Cash and Securities – This protection is included in Coterie’s base BOP

- Worker Dishonesty – This protection could be included in Coterie’s Silver, Gold, or Platinum endorsement packages accessible for a BOP coverage.

With the month of Might being Nationwide BBQ Month, it’s a good time to make sure that your shoppers within the cellular meals companies business have the best insurance coverage protection in place. Should you’re keen on writing insurance coverage for barbecue meals stands and meals vehicles, attain out to Coterie Insurance to study extra about our specialised insurance coverage options. We’re right here that can assist you present the absolute best protection on your shoppers on this thrilling and rising business.

[ad_2]