[ad_1]

Thomas Greene had been experiencing ache in his proper leg, a complication from diabetes, when medical doctors really helpful a process to extend blood circulation to the limb.

Retired from a profession as an electrician and HVAC technician, he had an outpatient process in April 2021 to alleviate his ache by dilating the clogged artery utilizing a balloon snaked into his blood vessel.

Greene, who lives in Oxford, Pennsylvania, got here by way of the process with none issues, and it decreased his discomfort, stated his spouse, Bluizer Greene. She spoke with KFF Well being Information on behalf of Greene, who’s recovering from different well being issues.

Greene is roofed by Medicare and a supplemental coverage by way of Humana and didn’t anticipate to pay something for the care, Bluizer stated.

Then the payments got here.

The Affected person: Thomas Greene, 74, who is roofed by unique Medicare and a Medicare complement coverage bought by Humana.

Medical Service: Peripheral artery bypass surgical procedure on Greene’s proper leg.

Service Supplier: The operation was carried out at Jennersville Hospital in West Grove, Pennsylvania, which closed in December 2021. Anesthesia companies had been offered by two suppliers who work for North American Companions in Anesthesia, which is private equity-owned and, with 1000’s of suppliers working in 21 states, identifies itself as among the many nation’s largest anesthesia staffing corporations.

Complete Invoice: For the anesthesia care, North American Companions in Anesthesia billed $2,965.58: $1,334.51 for an authorized nurse anesthetist and $1,631.07 for an anesthesiologist.

What Offers: North American Companions in Anesthesia, or NAPA, pursued Greene to pay for his anesthesia care as an alternative of billing Medicare on time, sending the debt to collections earlier than the couple found the issue.

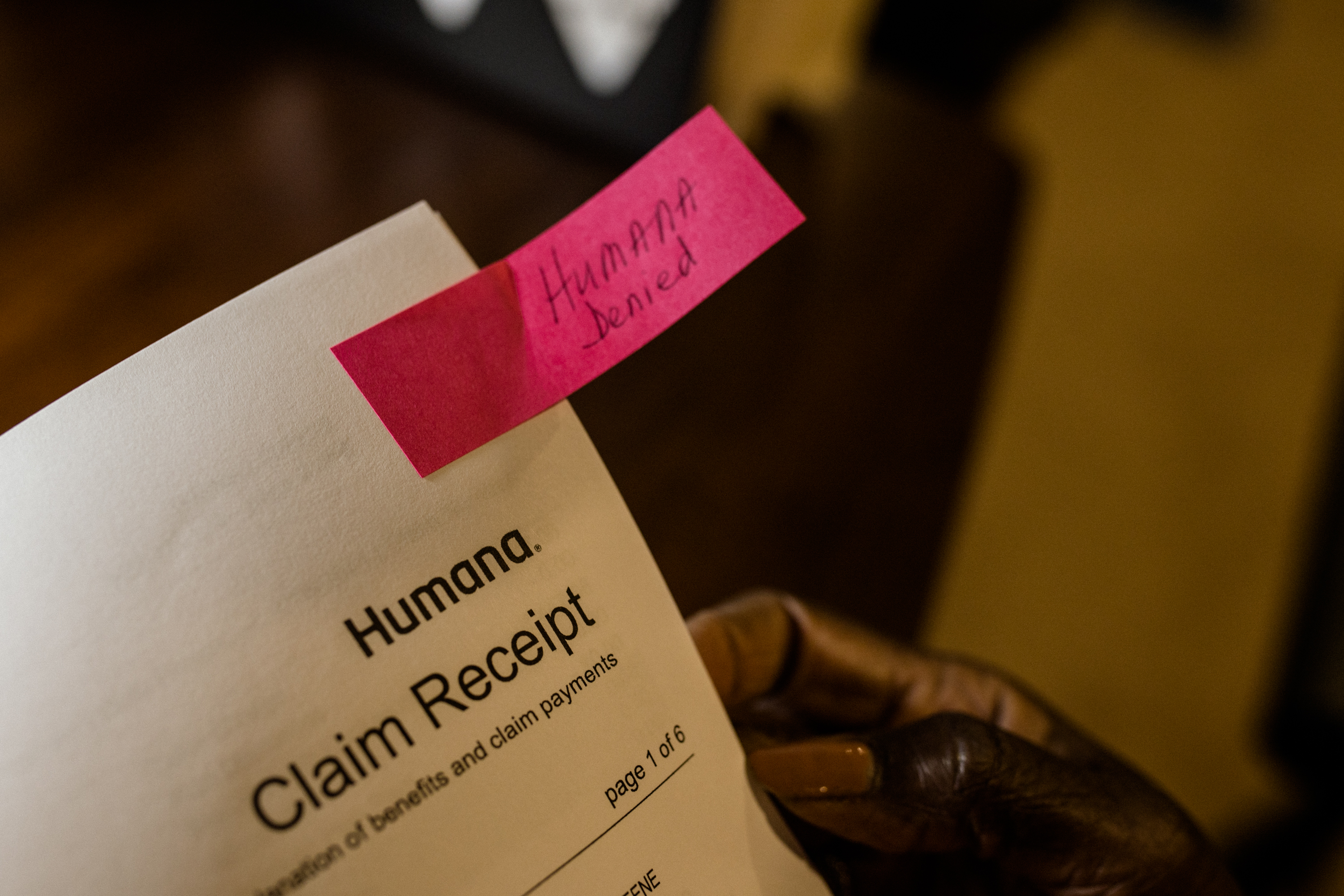

Medicare finally acquired the claims from NAPA, months after the couple began receiving assortment letters, Bluizer stated. However Medicare denied them as a result of they had been filed late — practically 17 months after the surgical procedure. Humana additionally denied the claims.

Medicare requires providers to submit claims inside a 12 months of offering their companies. And Medicare supplemental insurance policies, like Greene’s plan from Humana, usually don’t pay for companies if Medicare doesn’t cowl them, whether or not as a result of Medicare has not paid its half but or as a result of this system denied the declare.

A 12 months after Greene’s surgical procedure, in spring 2022, the couple opened a letter from a group company engaged on behalf of the anesthesia group. It demanded Greene pay about $3,000.

“One thing must be fallacious, as a result of that is the primary time my husband has ever been requested to pay out-of-pocket and we’ve had the identical insurance coverage for years,” Bluizer stated.

She stated for a number of months she referred to as NAPA and the gathering company, C.tech Collections, of Mount Sinai, New York, to find out why it was billing her husband.

Greene was additionally contacted by the Faloni Legislation Group, a second group engaged on behalf of NAPA to gather the debt, and Bluizer stated she adopted its directions to reply by mail, disputing the debt on the grounds that it needs to be billed to insurance coverage.

However her communication makes an attempt didn’t resolve the problem, and he or she stated her husband continued to obtain assortment notices.

Neither debt collector responded to requests for remark.

“We had been offended, and it was very upsetting as a result of we had by no means had a invoice put into a group company for any of his hospitalizations, and it was cash we didn’t really feel that we owed,” Bluizer stated.

She stated they might have acquired some letters from the anesthesia group in 2021 and 2022 that they discarded with out opening as a result of they believed her husband’s medical payments can be lined by insurance coverage, as the remainder of his surgical procedure payments had been.

Anxious in regards to the state of affairs, together with its potential affect on their credit score, the couple reached out late final 12 months to Harold Ting, a volunteer counselor for Pennsylvania’s MEDI program, which supplies free help to Medicare beneficiaries. Medicare usually covers anesthesia companies.

“That is completely unfair {that a} beneficiary finally ends up having to pay for what needs to be a very lined service, when the supplier is at fault,” Ting stated.

Two clarification of advantages statements from Humana present the insurer acquired claims from NAPA in April 2021, shortly after Greene’s surgical procedure. The statements stated the claims couldn’t be thought of at the moment, although, as a result of Humana had not but acquired Medicare EOBs for the companies.

Kelli LeGaspi, a Humana spokesperson, declined to touch upon Greene’s case. She stated a Medicare EOB — a protection assertion generated when this system processes a declare — is required for the complement service to think about a declare. With out it, a declare for secondary protection can’t be thought of and is denied, she stated.

Complement plans deny claims for advantages which might be denied by Medicare, she stated.

“If Unique Medicare declines to pay the declare, then the Medicare complement plan is required to say no the declare as properly,” she stated in an e-mail.

In December 2022, a NAPA consultant instructed Bluizer in an e-mail that NAPA billed Medicare after the April 2021 surgical procedure and that Medicare denied the claims in August 2021. The consultant offered an account assertion displaying the claims had been despatched to collections that month.

However Bluizer stated a Medicare consultant instructed her in late 2021 that this system had acquired no claims from NAPA.

Greene’s Medicare account exhibits NAPA filed claims in September 2022, about 17 months after his surgical procedure and about 5 months after he acquired his first assortment letter. Each claims had been denied.

A quarterly abstract discover stated whereas the time restrict for submitting the claims had expired, Greene additionally couldn’t be billed.

Meena Seshamani, director of the federal Heart for Medicare, stated in an e-mail to KFF Well being Information that if a Medicare supplier sends a declare a 12 months or extra after a service is offered, it’s denied besides in very uncommon circumstances.

There isn’t any exception for supplier error, she stated.

A spokesperson for NAPA declined to be interviewed on the document, regardless of receiving a signed launch waiving federal privateness protections.

Martine G. Brousse, a billing knowledgeable and founding father of the affected person advocacy agency AdviMedPRO, stated Greene’s Medicare discover ought to have reassured the couple that he didn’t owe something, regardless of the a number of overdue-bill notices they acquired.

If the Medicare assertion “exhibits a zero stability to the member, then the supplier can’t legally go after the affected person,” stated Brousse, who is just not concerned in Greene’s case. “The affected person has zero legal responsibility as a result of it isn’t their fault” the supplier billed Medicare a 12 months after the surgical procedure. “That’s the finish of the story.”

One other thriller in regards to the declare is why NAPA billed individually for a nurse anesthetist and an anesthesiologist. Bluizer stated her husband was not instructed why NAPA billed individually for the 2 medical professionals — a follow some insurers imagine constitutes double billing.

Brousse stated there might be a easy clarification, comparable to if the nurse anesthetist began the process and the anesthesiologist completed it or if the corporate charged for the anesthesiologist to work in a supervisory position.

However the Medicare claims doc exhibits every supplier billed for a similar period of time — a bit of over an hour.

“So far as I can inform, this appears like two suppliers billed with the identical ‘I did the job’ Medicare process code,” she stated. “Medicare can’t settle for that with out an evidence.”

The Decision: Unable to get solutions, Ting related Greene to the nonprofit, Pennsylvania-based Center for Advocacy for the Rights and Interests of Elders.

In March, Ariel Rabinovic, an advocate with the middle, contacted NAPA on Greene’s behalf and defined that federal regulation doesn’t permit the group to invoice Medicare sufferers for companies Medicare doesn’t cowl. He stated he was instructed the corporate would cease billing Greene.

Bluizer stated the couple has not acquired any assortment notices since then.

Rabinovic stated he has seen different conditions by which well being suppliers who agree to simply accept Medicare attempt to invoice sufferers for companies Medicare doesn’t cowl, which isn’t allowed.

“Older people have plenty of issues happening, and coping with this may be very complicated for them,” he stated. “Lots of people find yourself paying as a result of they don’t wish to cope with it.”

Greene has confronted a number of well being points and hung out in a rehabilitation hospital this winter. His spouse stated she was completely happy the billing challenge had been resolved with out their having to pay something.

The Takeaway: When a Medicare assertion says the affected person is probably not billed something for a well being service, that’s the underside line. Don’t write a examine, but in addition don’t ignore payments and assortment notices, as a result of they might finally harm your credit score.

Learn your mail, the specialists stated. Whereas Greene was not accountable for paying the anesthesia invoice on condition that Medicare stated he didn’t owe something, the couple could have prevented the debt from being despatched to collections if they’d responded to the anesthesia group’s communications and confirmed it had Greene’s insurance coverage data, Brousse stated.

Maintain copies of payments and insurance coverage statements, particularly Medicare EOB paperwork, or observe them on a web based portal.

The couple was sensible to succeed in out to advocates for assist resolving the problem once they couldn’t achieve this on their very own, Rabinovic stated.

“That is why individuals have to learn their notices from Medicare even when it says ‘This isn’t a invoice,’” he stated.

Additionally, when an anesthesia invoice consists of prices for each a nurse anesthetist and an anesthesiologist, query the fees. Many insurers is not going to pay for each.

The Facilities for Medicare & Medicaid Companies advocate beneficiaries name 800-MEDICARE with questions on their care or payments or file a complaint online.

Invoice of the Month is a crowdsourced investigation by KFF Health News and NPR that dissects and explains medical payments. Do you’ve an fascinating medical invoice you wish to share with us? Tell us about it!

[ad_2]